Renters Insurance in and around Oldsmar

Oldsmar renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Oldsmar Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented house or townhouse, renters insurance can be the right decision to protect your stuff, including your books, bicycle, stereo, children's toys, and more.

Oldsmar renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Oldsmar Choose State Farm

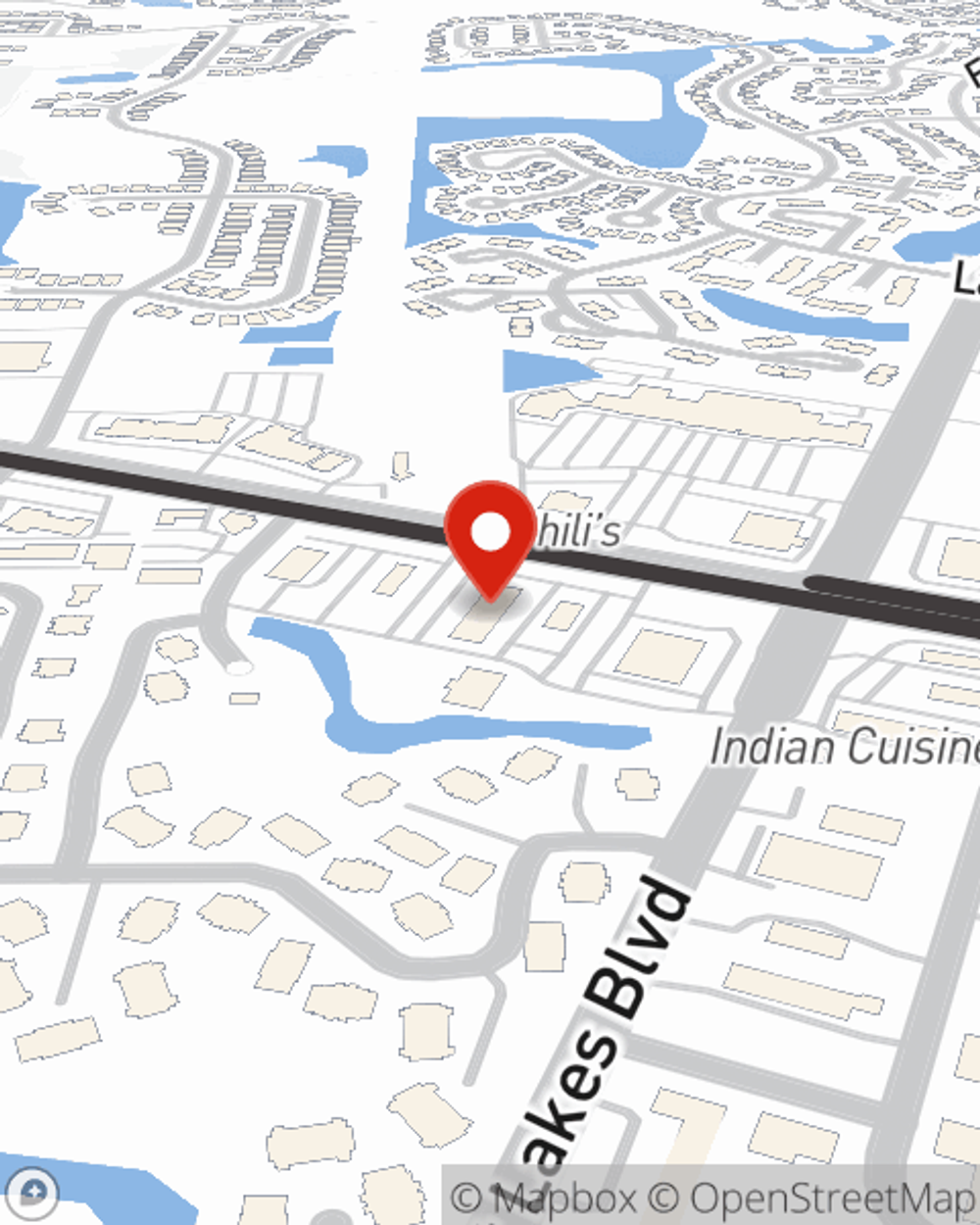

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Stephen Belau can help you create a policy for when the unanticipated, like a fire or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Oldsmar renters, are you ready to see how helpful renters insurance can be? Call or email State Farm Agent Stephen Belau today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Stephen at (813) 343-0926 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Stephen Belau

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.